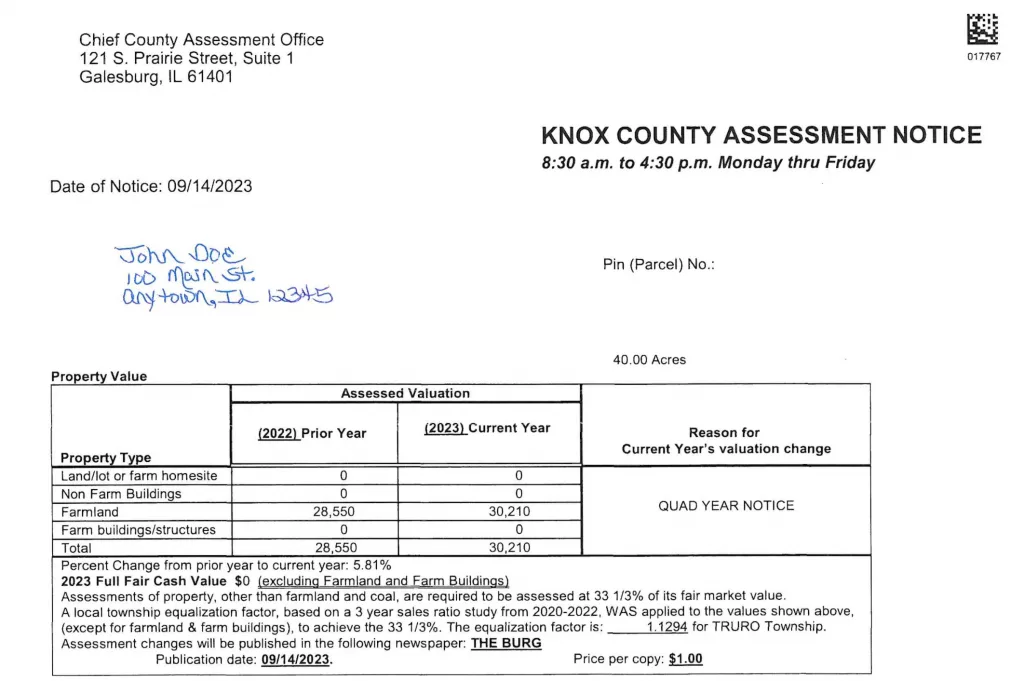

Many property owners in Knox County received their Quad Year Notice from the Knox County Assessment Office this week.

Do you have questions about the letter or how the figures were determined? Here are six things to know about the assessment, courtesy Sonia Hochstetler, Chief County Assessment Officer/Zoning Administrator for the Knox County Assessment Office.

What is the ‘quad year’ and ‘general reassessment year’?

During a “Quad Year” the Township Assessors are to view and adjust the property assessment of every parcel to current Market Value based on a 3-year area average, which MAY include, “new construction or demolition.”

During a “General reassessment year” the Township Assessors are to add any new construction (if found) or make any corrections to assessments based on FACTS (not opinions) and/or remove any demolition (if notified by the property owner).

Why did I receive or not receive an assessment notice in the mail?

The state requires us to mail notices to all properties located in a “quad year” and property that has farm ground in every township, and every property that had an assessment change in a “general assessment year,“ excluding the multiplier.

How is my property’s assessment determined?

The Township Assessors are to assess the property at 33 1/3% of its fair cash value. This is done with a 3-year average of Market Value from the County sales. This is using all the attributes and features of the property.

What should I do if I think my property is over-assessed?

They should review the attributes and features of the property with the Township Assessor to determine the details correctness. Once that is complete, if they still feel it is over-assessed, they should file an appeal with the Knox County Board of Review. Forms to appeal are located at each assessment office in the county and on the county website: https://co.knox.il.us/assessment-office/

Why are my taxes higher, or did they go up more than my neighbors? Does the same rate apply to everyone?

- Tax RATES are determined at the Knox County Clerks office. They take the Levy’s needed by all the taxing districts from where each property is in the county and divide it into the Equalized Assessed Value available to determine each rate to provide the dollars needed to run those offices. Those RATES are then used on your assessed value to determine your taxes. Whether your assessment goes up or down does not determine higher taxes.

- They may or may not go up more than your neighbors in a “Quad Year.” In a “General Assessment year”, more often than not your neighbors will go up or down the same amount.

- Rates can be different for neighbors if they lay on the edges of taxing districts. If your neighbor is in the same taxing districts as your property than your rate will be the same.

Where do the taxes go?

The good news is that all your taxes stay in Knox County. They are used to run all the taxing districts listed on your tax bill. Please refer to that for clarity (Examples) Fire Department, Library, School etc.